2025 Market Report: A Year of Repricing and Resilience

Sovereign Risk Repricing, Policy Normalization, and a Strengthening Shekel

Since October 2023, the dominant force shaping Israeli asset prices has been the market’s attempt to price — and subsequently reprice — geopolitical risk. In 2025, that repricing progressed in a meaningful and observable way.

The Gaza ceasefire and hostage return removed a major source of immediate uncertainty. Stabilization along the northern border reduced the likelihood of a multi-front escalation. The brief but intense 12-day war with Iran, while underscoring regional volatility, ultimately reinforced deterrence dynamics rather than undermining them. Throughout this period, U.S.–Israel defense coordination remained robust, providing an important anchor for investor confidence.

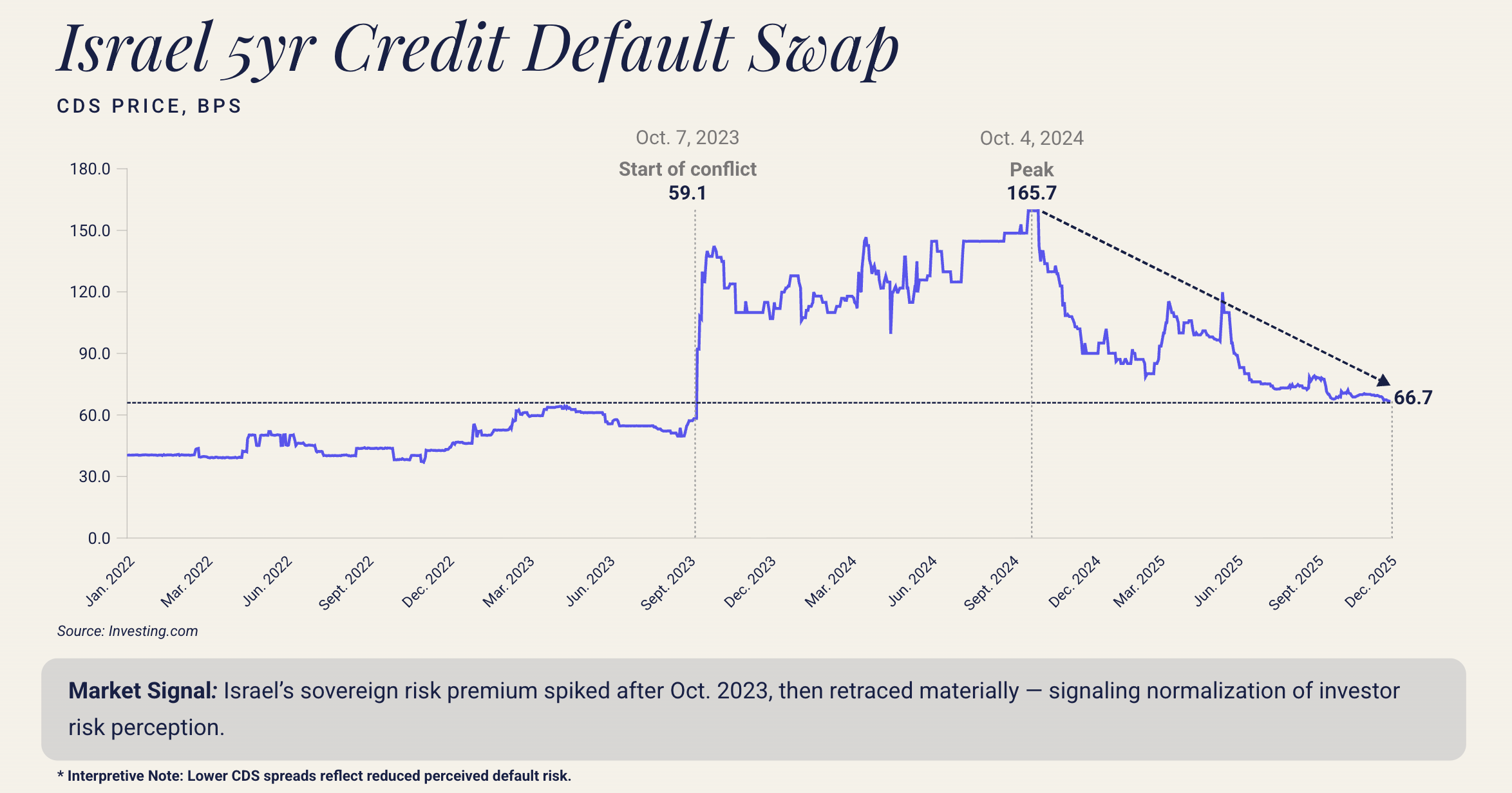

These developments were reflected most clearly in sovereign markets. Israel’s 5-year credit default swap spread tightened by roughly 97 basis points from its wartime peak, ending the year near ~66 basis points. While still above pre-conflict levels, this move represented a clear shift away from pricing existential or systemic risk toward a more conventional sovereign risk premium. Notably, this repricing occurred while Israel’s formal credit ratings remained intact — A (S&P), Baa1 (Moody’s), A (Fitch) — reinforcing confidence in the country’s institutional strength and fiscal credibility.

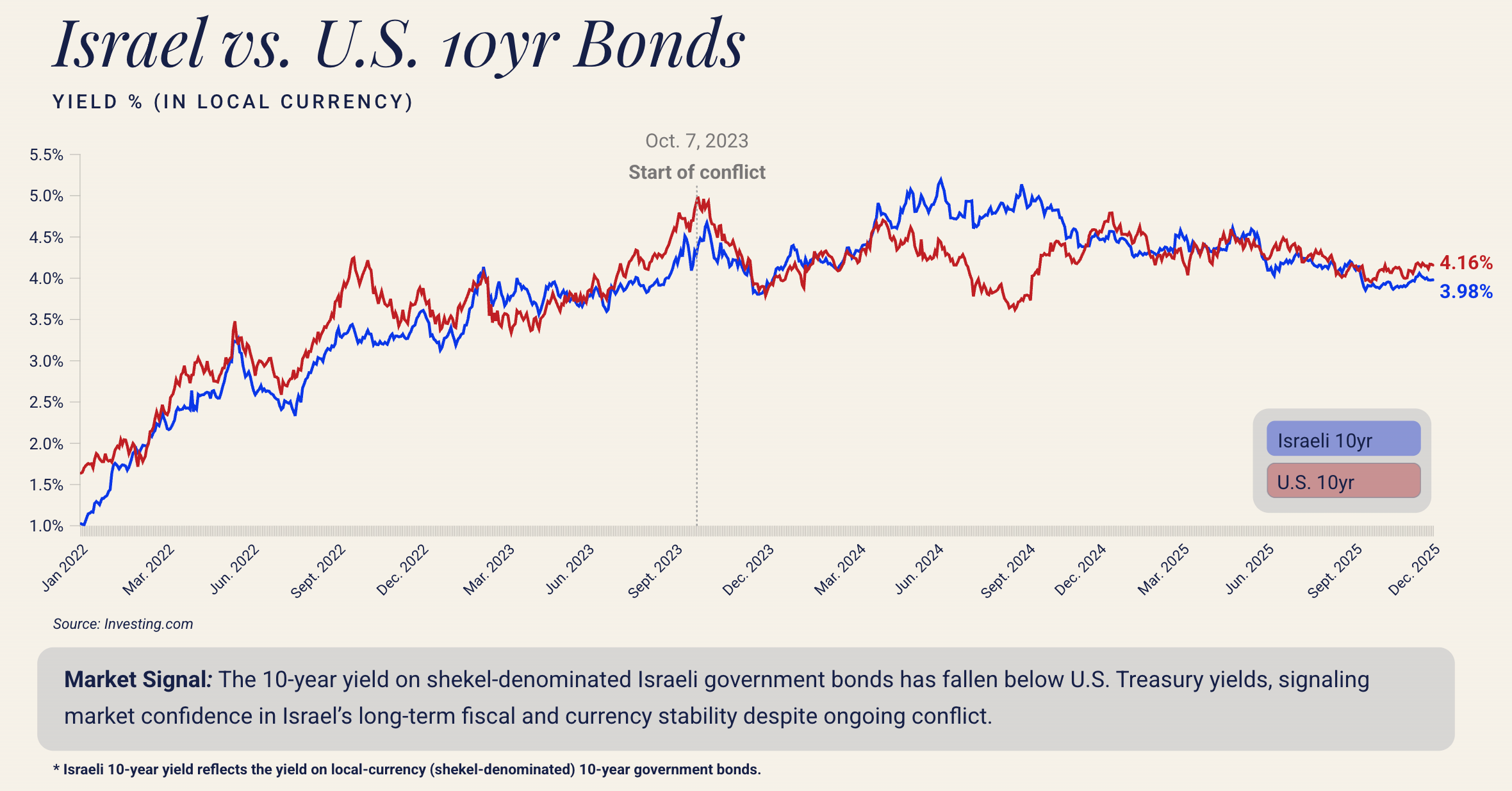

Normalization was also evident in the sovereign bond market. Over the course of 2025, the 10-year yield on shekel-denominated Israeli government bonds declined to levels below those of U.S. Treasuries. This inversion is notable given Israel’s recent security challenges. It reflects expectations that the shekel will remain stable — or continue to strengthen — over time, or at a minimum, that major bond-market participants remain reluctant to position against the currency despite the ongoing state of conflict.

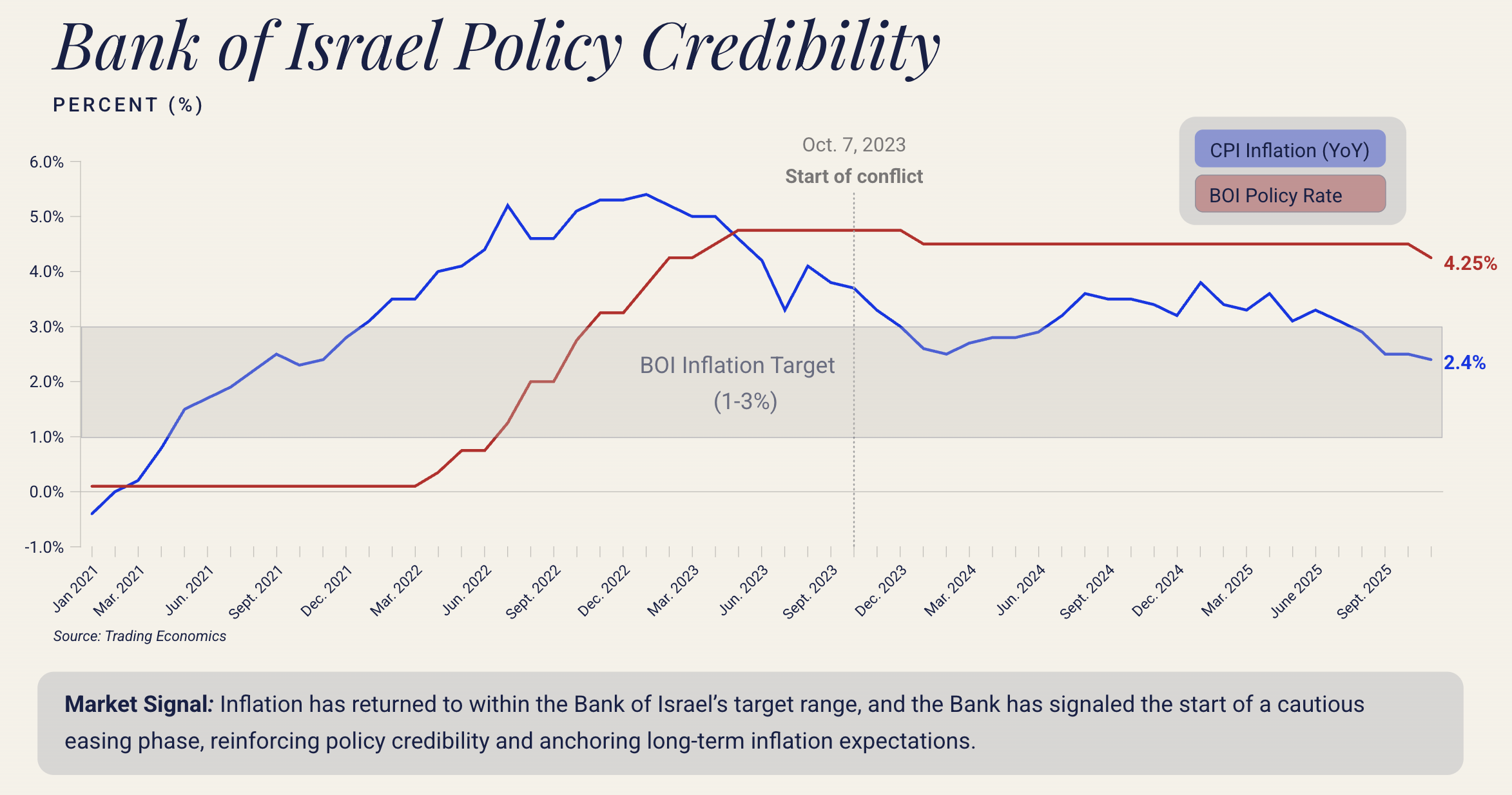

Monetary conditions also evolved over the year. Inflation moderated steadily, with headline inflation declining to approximately 2.4% over the past 12 months, comfortably within the Bank of Israel’s target range. Against this backdrop, the Bank of Israel reduced its policy rate in November to 4.25%, where it stood at year-end, formally signaling the beginning of an easing cycle. The Bank’s outlook assumes continued security stabilization and a gradual realignment of GDP toward its pre-conflict trend as supply-side constraints ease and domestic demand recovers.

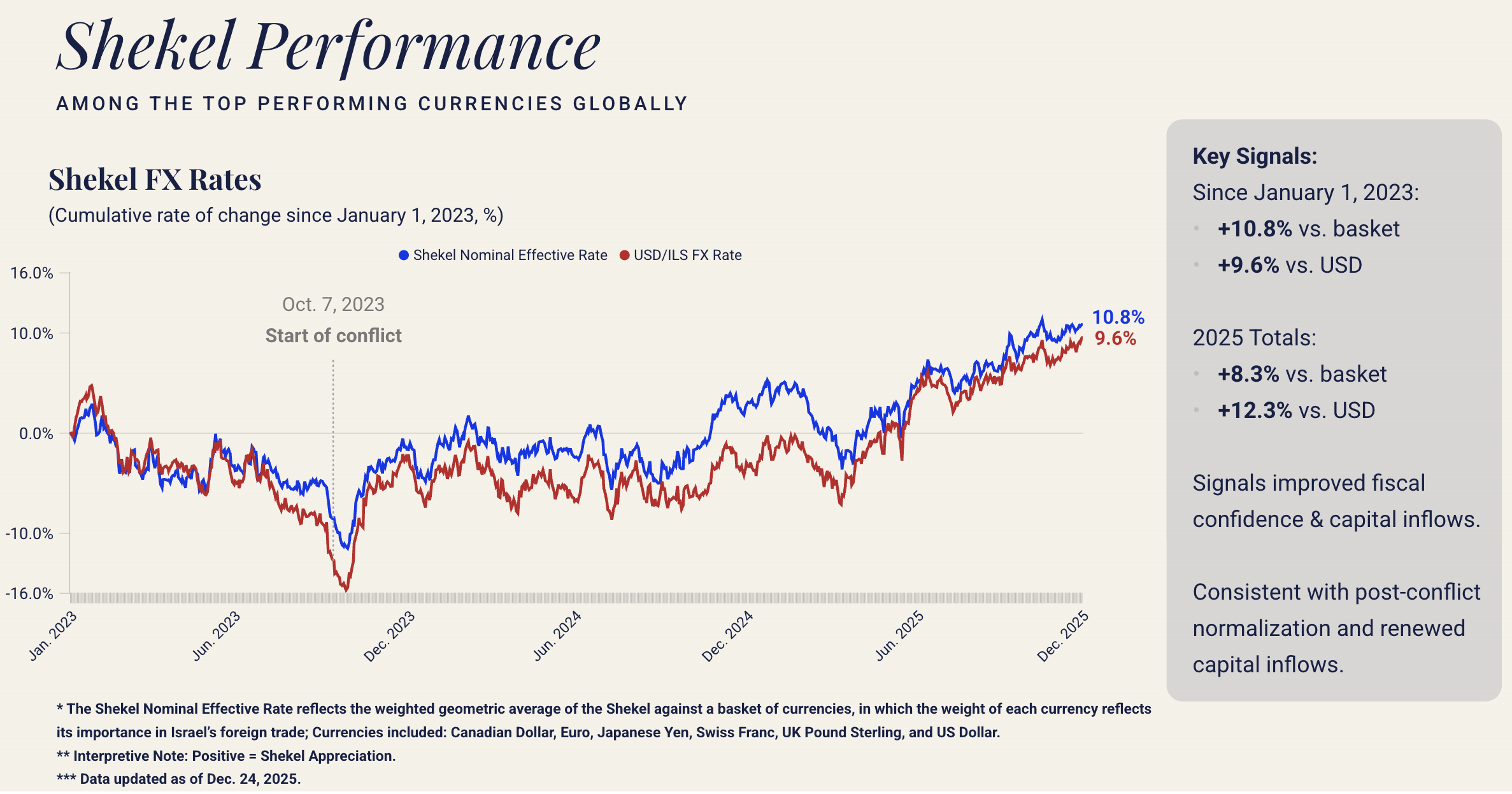

Currency dynamics reinforced this stabilization narrative. On a nominal effective basis, the shekel recovered meaningfully from its October 2023 lows, reflecting improving risk sentiment, resilient export activity, and strong external balances. More importantly for U.S. investors, the shekel strengthened roughly 12.3% against the U.S. dollar over the course of 2025.

This performance placed the shekel among the stronger-performing currencies globally in 2025 and was supported by record foreign-exchange reserves exceeding $200 billion, providing the Bank of Israel with meaningful policy flexibility.

Capital Markets: Equity and Fixed Income

Israel’s capital markets operated continuously throughout 2025, demonstrating adaptability amid elevated uncertainty.

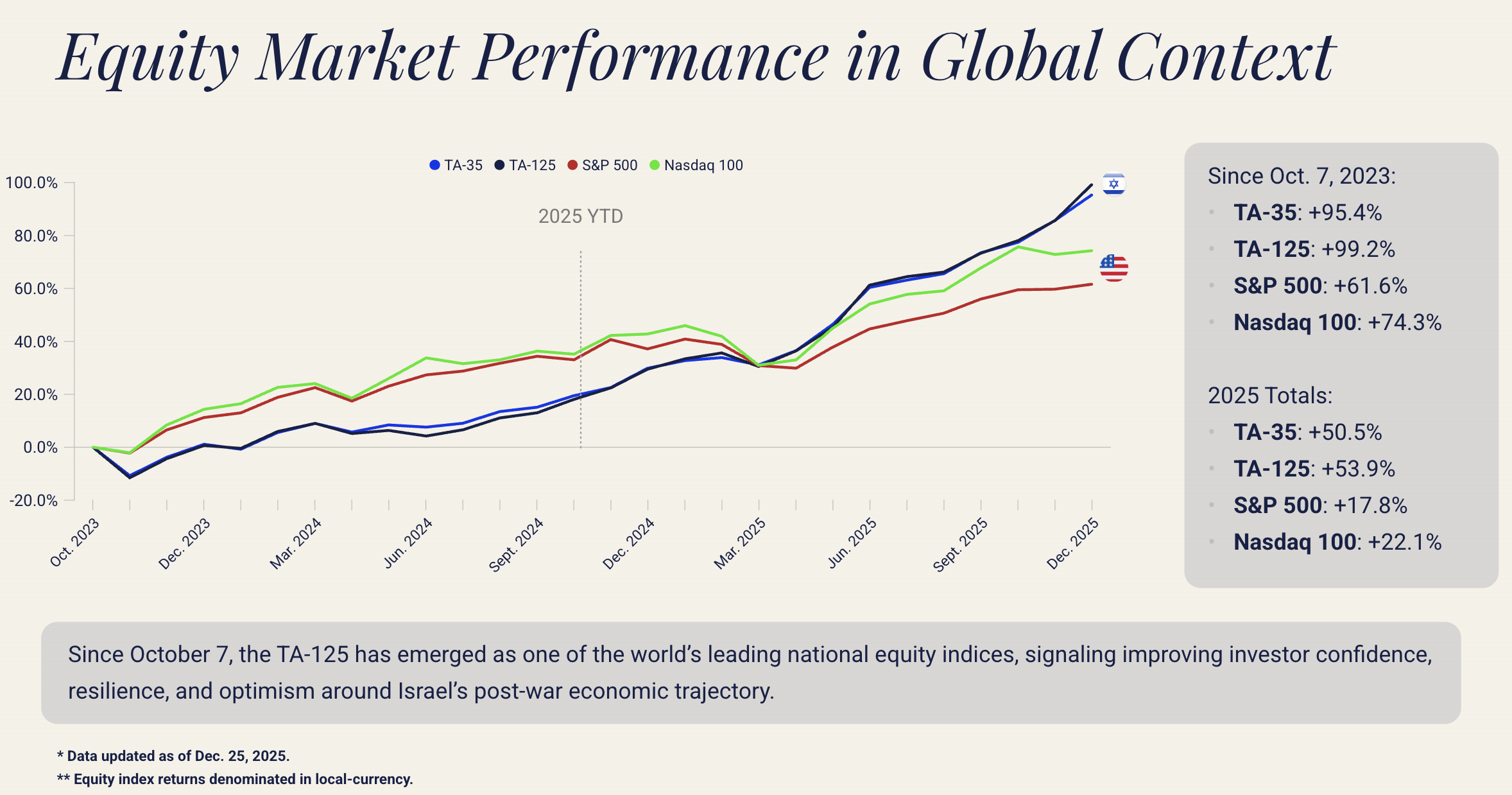

Israeli equities ranked among the strongest performers globally. The TA-125 Index emerged as one of the world’s leading equity indices, materially outperforming many developed-market benchmarks. Performance was broad-based and occurred alongside rising liquidity and participation, underscoring the depth and functionality of the Tel Aviv Stock Exchange even during periods of heightened volatility.

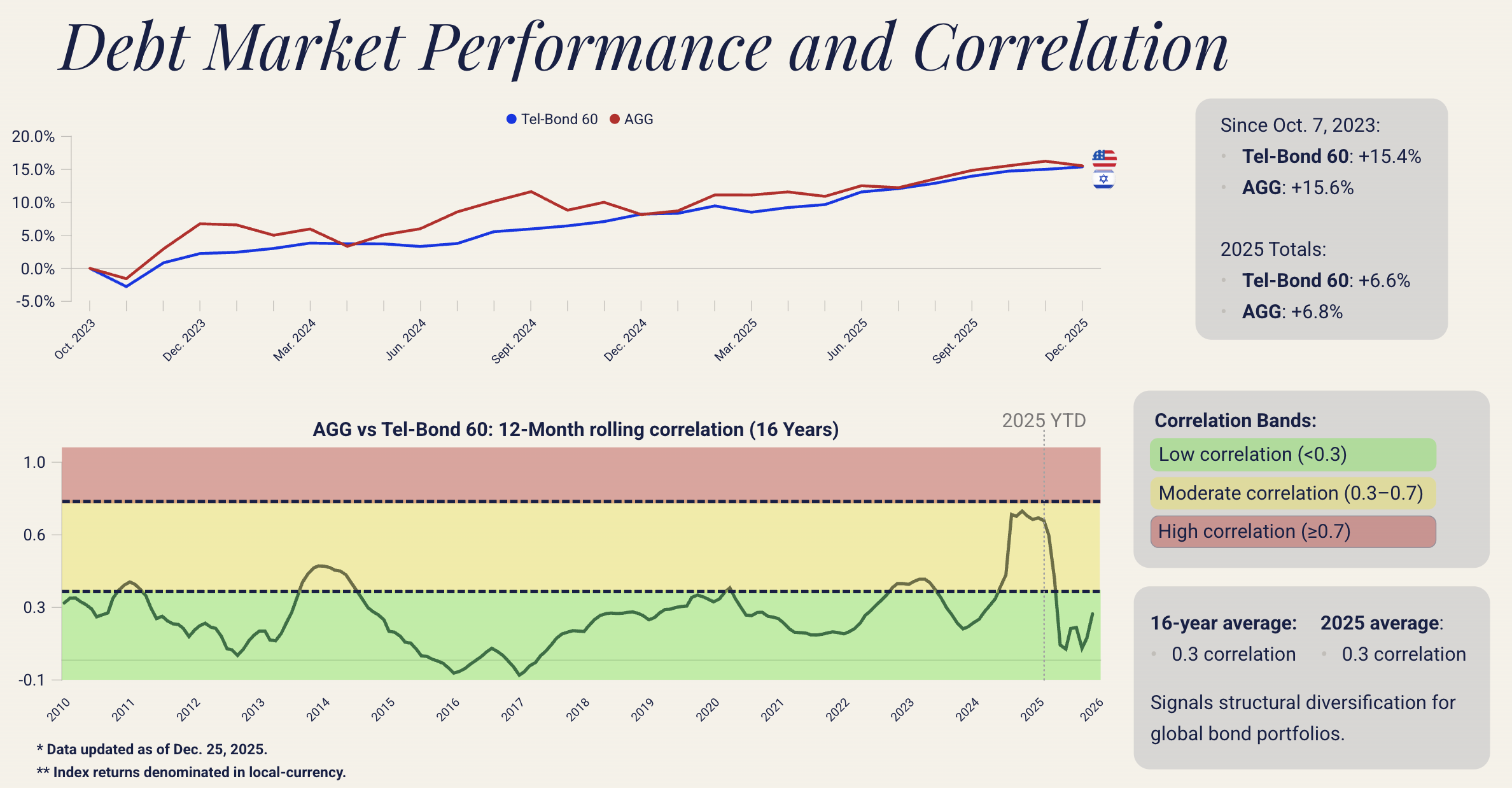

Fixed-income markets were shaped less by immediate policy action and more by anticipation, positioning, and market structure. For most of the year, the Bank of Israel maintained a restrictive stance, with the first rate cut not occurring until November. As a result, bond-market behavior reflected evolving expectations around inflation, growth, and geopolitical risk rather than an active easing cycle.

Investment-grade credit conditions improved gradually. Spreads tightened over the course of the year, supported by stabilizing macro conditions and steady local demand, though pricing remained fragmented. The Israeli bond market’s retail-dominated investor base and index-driven flows continued to create pockets of technical mispricing, particularly within higher-quality A and AA credits. Despite restrictive policy and episodic volatility, Israel’s core bond indices delivered positive returns in 2025, highlighting the resilience of the market and the importance of structure, carry, and security selection.

Looking Ahead to 2026

Despite ongoing challenges — including elevated war-related expenditures, a prolonged high-interest-rate environment, labor constraints, and internal tensions — the Israeli economy has continued to demonstrate resilience. Assuming the geopolitical situation does not materially deteriorate, and potentially improves alongside broader regional developments, continued diplomatic progress, and further normalization of foreign investor confidence, we remain cautiously optimistic that 2026 will represent a continuation of the positive trend that began in the second half of 2025.

Inflation is expected to remain well contained, with consensus estimates pointing to annual inflation of approximately 1.8%, comfortably within the Bank of Israel’s target range. In this environment, monetary policy is likely to shift gradually toward easing, with markets pricing three to four rate cuts over the course of the year, though the Bank of Israel is expected to proceed cautiously. Israeli equities are no longer inexpensive by historical standards; however, declining risk premiums, anticipated rate cuts, expectations for accelerating economic growth, and the potential for further shekel strength continue to provide support. Consensus forecasts from the Ministry of Finance, the Bank of Israel, S&P, and the OECD point to economic growth of approximately 4.7%–5.2% in 2026 — high by developed-market standards — which, together with lower interest rates, may reduce the relative attractiveness of deposits and support continued capital flows into risk assets, albeit with the possibility of episodic volatility tied to geopolitical developments.

In fixed income, corporate bond spreads enter 2026 near historic lows; nevertheless, an easing rate environment and contained inflation are likely to support continued demand and constructive performance. Within this backdrop, a balanced exposure between nominal and CPI-linked bonds remains appropriate, with medium-to-long-term CPI-linked bonds continuing to offer attractive risk-reward at current inflation expectations. From a currency perspective, absent a significant external shock — such as renewed military escalation or a sharp global risk-off event — the most likely outcome is consolidation around current USD/ILS levels with a bias toward gradual shekel appreciation, while meaningful diplomatic progress could support sharper strengthening and renewed conflict could lead to rapid depreciation.

About Kotel Investment Management: We serve as a bridge between U.S. capital and Israel’s overlooked fixed income markets, sharing insights and perspective through our research and thought leadership.

This content is for informational and educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities.