Ahead of the BOI: What Tomorrow’s Rate Decision Means for Yields and Portfolios

A Moment That Moves More Than Sentiment

The Bank of Israel meets tomorrow, and while most people will focus on whether the rate moves by 25 or 50 basis points — or whether they hold — the real significance sits beneath the headline. A central-bank decision always ripples through the credit markets, in Israel just as it does in every developed market.

A policy shift doesn’t just send a message. It resets expectations, moves the government curve, and reprices credit. For investors who hold duration or corporate exposure, that matters far more than the headline number.

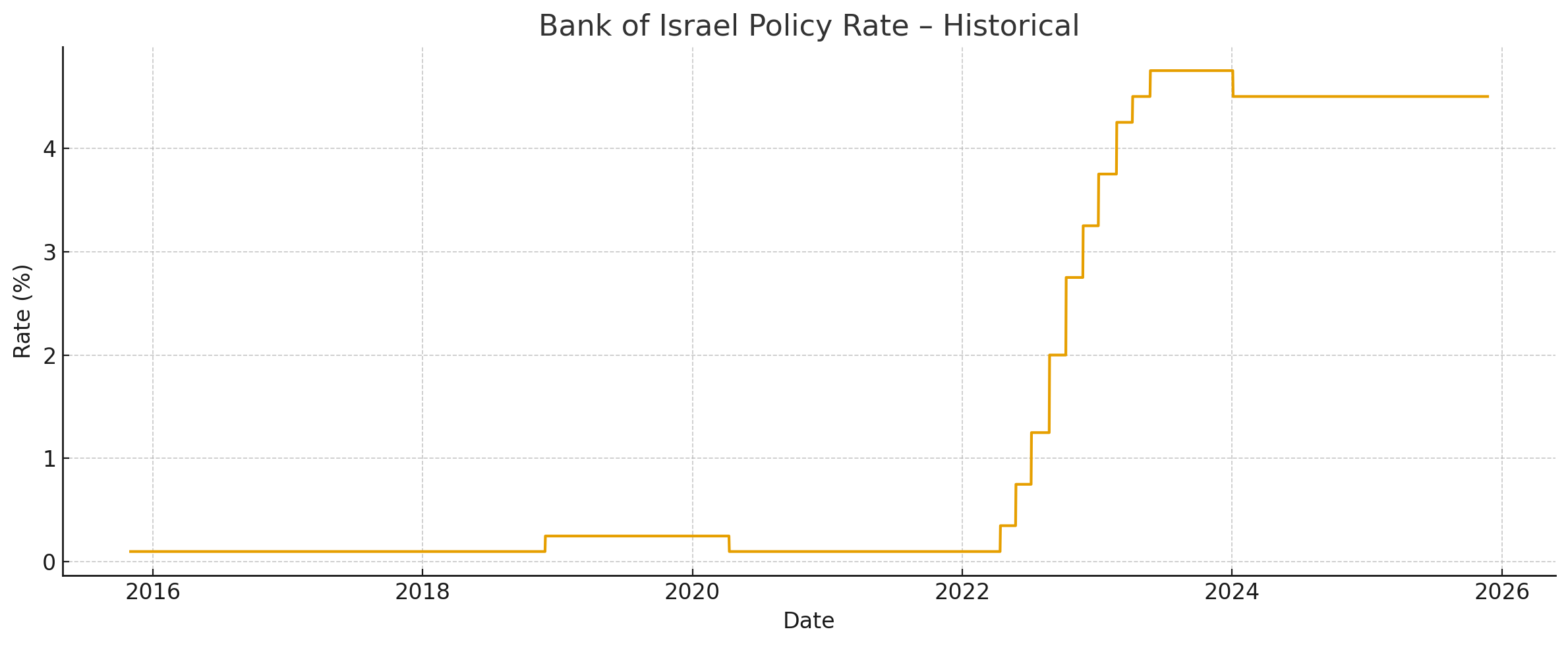

Where Israel is Coming From: A Decade of Policy Rates

Before looking ahead to tomorrow, it’s worth looking back at Israel’s recent rate history. The BOI held rates near zero for years, then executed its fastest modern tightening cycle in response to post-COVID inflation and global conditions. Israel is now sitting on that plateau, with inflation back in the target range and conditions aligned for potential easing.

This context matters. Israel is no longer in the “emergency cuts” of 2020, nor the “emergency hikes” of 2022–23. The BOI is at an inflection point — and inflection points tend to move curves, spreads, and valuations.

Below is the full rate journey:

BOI 10-Year Historical Interest Rates

The Macro Conditions Behind Tomorrow’s Decision

Tomorrow’s meeting isn’t happening in isolation. A few key macro dynamics explain why a rate cut is expected:

Inflation has moved back into the BOI’s 1–3% target range, coming in lower than expected last month at 2.5%, with projections now pointing toward ~2% inflation over the next 12 months.

The shekel has strengthened in recent months, up about ~10.3% YTD versus the Dollar, easing imported inflation pressures and giving policymakers more space to act.

FX reserves remain near record highs at about $200B, reinforcing external stability and reducing the risk of currency-driven inflation.

Growth expectations for 2025 have stabilized, and corporate balance sheets remain broadly resilient.

The security picture has stabilized following the Gaza ceasefire.

None of these guarantee a cut — but they explain why the BOI has more flexibility now than at any point in the past two years.

How Interest Rates Feed Directly Into Bond Yields and Prices

If the BOI cuts tomorrow, the transmission mechanism is straightforward:

Short-term government yields decline first, since they are anchored directly to policy.

The belly of the curve (2-10 years) shifts next, reflecting expectations for the broader easing path.

Long-duration bonds (>10 years) tend to see the largest price gains, because their values are most sensitive to falling yields.

Corporate bonds — which price off the government curve plus a spread — should also adjust quickly.

Because yields and prices move inversely, falling yields lift bond prices.

That’s true everywhere — and tomorrow is no exception.

The Government Curve Should Be the First to React

The ILGOV curve typically adjusts quickly around BOI decisions. A cut of any size can pull down the front end of the curve, and if markets believe more easing is ahead, the entire 2–10 year segment often shifts lower as well.

This curve movement is what investors should be watching most closely: it is the cleanest way to understand what the market believes the BOI will do next. And is often the quickest to respond to central bank policy rate cuts.

Corporate Bonds Should Follow Suit

Israeli corporate bonds generally price off the government curve. When yields fall:

Yields decrease

Prices of outstanding bonds rise

Refinancing conditions improve

Spreads can tighten if investors grow more comfortable with macro conditions

Because the market is exchange-traded, these adjustments happen in real time and are visible on the Tel Aviv Stock Exchange across the entire credit spectrum.

DV01: Where This Actually Shows Up in a Portfolio

DV01 (Dollar Value of 1 Basis Point) measures how much a portfolio gains or loses for every 1 bp move in yields. A long-biased bond portfolio naturally carries positive DV01, meaning it typically benefits when yields decline because falling yields push bond prices higher.

DV01 is simply the mechanism that turns policy shifts into portfolio P&L.

For well-positioned investors, that kind of environment can feel like a rising tide: as yields drift lower, the underlying value of the portfolio rises alongside them. The portfolio isn’t doing anything new — the market is pulling its value upward.

That sensitivity works both ways, of course. Positive DV01 helps when yields fall and detracts when yields rise. But ahead of a potential rate cut, it’s a useful way to understand how central-bank decisions show up directly in mark-to-market results.

Understanding DV01 makes it clear why tomorrow’s BOI decision is more than a headline — it directly affects the mechanics of portfolio valuation.

Israel’s Backdrop Supports Policy Flexibility

Tomorrow’s decision isn’t happening in isolation. A few broad trends have given the BOI more room to consider easing:

Inflation is back within the target range

The shekel has strengthened and stayed firm

FX reserves remain high and stable

Growth expectations for 2025 have improved

The U.S. Fed’s recent cut has eased global conditions

Corporate fundamentals remain solid

And the security picture has stabilized following the Gaza ceasefire

None of this guarantees a cut — but it’s why the conversation has shifted from if the BOI will ease to when and by how much.

About Kotel Investment Management: We serve as a bridge between U.S. capital and Israel’s overlooked fixed income markets, sharing insights and perspective through our research and thought leadership.

This content is for informational and educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities.